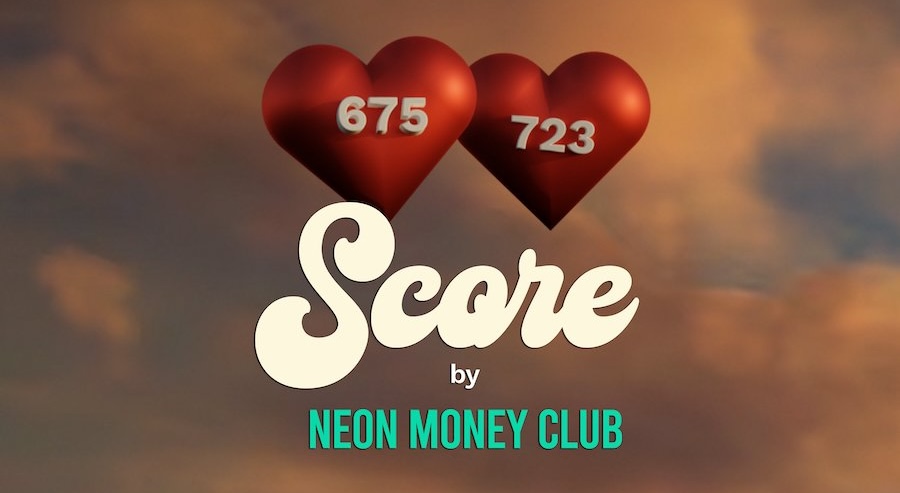

Score Dating App Wants You to Flaunt Your Credit Rating

Well grease my credit report and call me approved – there’s a controversial new player stirring up the always bubbling cauldron of online dating, Fatsters! I’m talking about an app called “Score” promising to pair up singles based on… drumroll… their credit scores!

Yep, you read that right. This fledgling service aims to make financial responsibility sexy again in the swipe right era. Find someone as creditworthy as you to get fiscally freaky with. But are parameters like payment history and debts owed really the turn-ons we should screen matches by? Let’s dive into whether Score’s lofty formula is brilliant or bunk.

Online Dating’s Murky Waters

First, context! I’m sure many Fatsters have braved the stormy seas of online dating themselves lately. And you don’t need Big B ‘s Wisdom to know nefarious creatures often lurk in those murky waters.

Between scam artists, catfishers, creepers, and the usual carousel of bad breakups – it’s enough to make anyone jaded about finding true love via apps. Ghosting, stale convos and zero relationship readiness abound. Not exactly environments cultivating long-term connection.

Yet people valiantly log on every day with hopes of uncovering that spark. It’s past time for fresh approaches, right?

Here Comes Score To Save Trust

Enter Score – a buzzy dating app concept that’s certainly creative, albeit controversial. The core premise? Help singles better assess romantic compatibility AND character by sharing credit scores and financial status.

Yep, economic eroticism at its finest here folks! The team at Score believes factors like responsible bill payment patterns, managed debt loads, credit mixing, and income levels offer honesty around how seriously date options take themselves. Almost an adulting aphrodisiac if you will.

Consider it hardcore hookup site meets Mint.com financial planner!

In theory, revealing fiscal health stats vets out the survey says…

- Deadbeats

- Gold diggers

- catfishers

- Broke scrubs

Sign me up to filter all those, right?

Scratching Below Score’s Shiny Surface

Scores certainly earning buzz with their tantalizing concept. But scratch below the shiny surface even slightly and troubles start to emerge on whether this theme sustainable scales an app.

For one – research shows credit worthiness correlates heavily with socioeconomic background over individual decisions. Should lower income folks get demoted for dating simply due to systemic disadvantages? Not everyone had supportive parents providing financial literacy lessons.

There’s also alarming potential for discrimination based on racial wealth gaps if algorithms depend too much on sterile credit numbers. Could this technology end up coded with bias? Lots of tricky variables in play.

Oh! And don’t discount the privacy pitfalls either. Personally I don’t love handing Equifax access to my love life data. Talk about a messy breakup!

Scoring Score’s True Upside

Now before totally discrediting the idea, I have to admit Score gets some fundamentals right. Trust and transparency DO matter tremendously when evaluating partners. And insight into money management styles offers clues there.

But as with most slippery slopes – it depends just how rigidly numbers get weighted over less quantifiable traits. Dating based predominantly on credit risks feeling mildly dehumanizing.

However, if Score instead positions financial stability as merely one optional indicator among many driving compatibility, it could carve a legitimate niche. People do value someone responsible. Mixing metrics with emotional intelligence feels future forward.

My take? Frame credit scores as interesting conversation starters rather than strict dealbreakers. Use money topics to spur deeper dialog on worldviews. Then the numbers serve their purpose as icebreakers without narrowly defining.

What Happens To My Score After Signup Surges?

In eventual news when Score inevitably takes off virally like spicy guacamole, I do wonder if unintended side effects emerge from financial data becoming a dating hot button.

Could we see more predatory lending behavior or credit card churns from folks artificially boosting numbers to impress matches? What about even sketchier adjusted score services popping up? Amazing how introducing reputation markers warps incentives eh?

And for seeker using Score sincerely, might unhealthy anxieties develop around maintaining certain credit levels or income brackets to remain in dating pools? Could move the needle towards inequality and status obsession.

Or maybe I’m being too cynical! With the right protections and educational guidance, sharing fiscal stats responsibly could nurture accountability. Either way, things could get interesting study-wise.

The Verdict? Ask Me After A Few Dates

Whelp, there you have it Fatsters – my characteristically hot take on what promises to be a fascinating financial experiment in modern matchmaking. I’m giving it 6 months before Score’s nucleus either implodes from controversy or gets acquired by Match Group. No middle ground!

But whether or not this plucky dating disrupter stands the test of time, they deserve credit for some financial bravery. And who knows – maybe a little incentive towards building good credit pays dividends with better partners!

Now if you’ll excuse me, I need to lock my credit report down tighter than Software Engineering Daily’s paywall before hopping on new dating apps. These bachelor credentials need protection! Toodles!

Read More

Kittl Just Raked in $36 Million For Its Browser-Based Design Toolkit

Kittl Just Raked in $36 Million For Its Browser-Based Design ToolkitSimmer down and grab some kombucha, Fatsters! We've got some refreshingly cool funding news popping off in the digital creative space thanks to Austria’s rapidly rising star Kittl. The slick software...

Sniffing Out Rare Diseases is Finally Getting Easier Thanks to AI Doctor Assistants

Sniffing Out Rare Diseases is Finally Getting Easier Thanks to AI Doctor AssistantsWhoa nelly, even thinking about the crushing stress of watching loved ones suffer mysterious symptoms with zero diagnosis makes my anxiety spike faster than my cousin Caleb after quad...

Using AI to Plan the Ultimate Family Vacation

Using AI to Plan the Ultimate Family VacationWell butter my backside and call me a biscuit! Is that travel bug nipping at you again, Fatsters? I feel ya. After being cooped up enduring this never-ending pandemic, Big B is JONESING to get his wanderlust on too. But...